Millennial Student Debt

Student Debt and Young America Annual Report and Comparison Tool

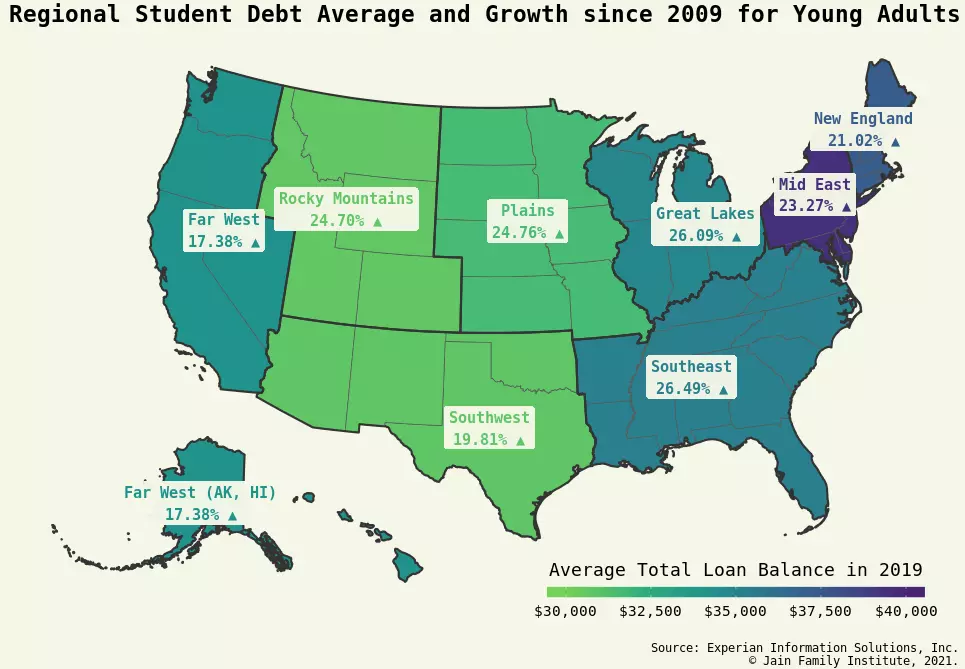

The number of borrowers, the amount they owe, and the number of loans each borrower acquires, have all increased since the Great Recession. In 2019, 18-35 year-olds with student loan debt owed nearly $35,000 on average compared to just over $28,000 (USD 2019) in 2009. Back in 2009 there were only 32 million federal borrowers; in 2019, that number swelled to 43 million. If young Americans can hope to obtain a future coherently similar to generations before them, student debt relief is a big part of the picture. By specifically studying 18-35 year olds, we hope to highlight the serious financial obstacle that student debt poses to young adults across the geographical and demographic spectrum.The main topics in the report include:

- Debt X Income

- Debt X Costs

- Debt X Repayment

- Debt X Forgiveness

View the full report as an interactive web page here, and as a downloadable PDF here.

Explore the Millennial Student Debt – Comparison Tool, which allows for interactive comparisons of higher education and debt statistics for specific geographic areas at the national, state or congressional district level. Find a video tutorial for the tool here.

View the press release here.