Social Wealth

From natural resources to physical infrastructure, public assets represent a shared inheritance — yet their management is often underthought. JFI’s Social Wealth initiative seeks to develop financial infrastructure to transform these assets into long-term portfolios that can facilitate the wider distribution of returns to capital, endow critical social programs, and catalyze inclusive economic development. Our aim is to aid the management of social wealth funds, drive the democratization of finance, and strengthen the solidarity economy.

Drawing on resources from across the public, private, and academic spheres, JFI builds tools, conducts basic and applied research, convenes scholars and practitioners, and develops partnerships to help transform public assets into long-term financial portfolios in service of the public interest.

PARTNER WITH US

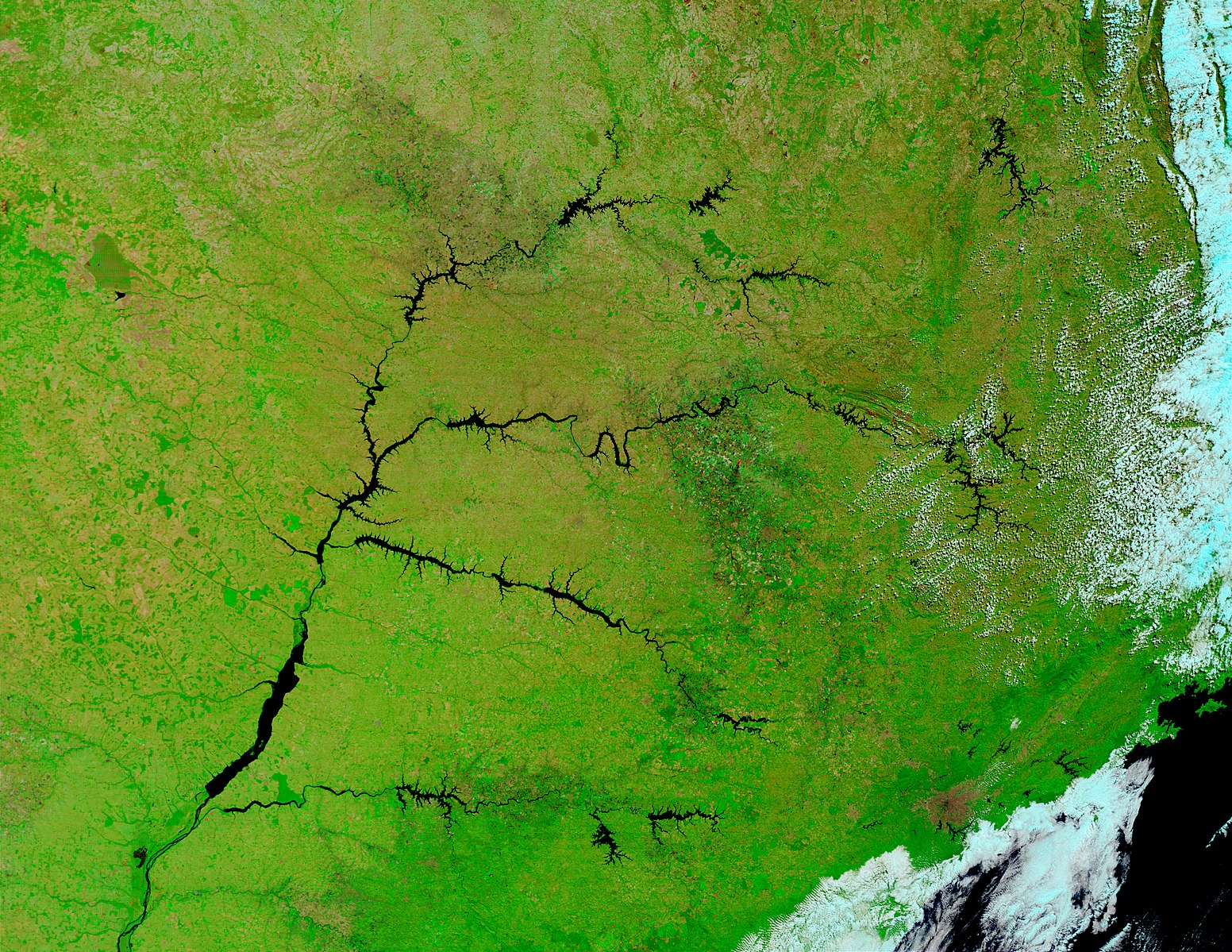

We partner with social wealth fund managers, academics, policymakers, and government officials in the US and abroad. Examples of this work include a study of financing and infrastructural options to support cash transfers and economic development in Compton, California, as well as our ongoing collaboration with UFF and the Treasury of Niterói, Brazil to develop tools and resources for the newly created Fundo de Equalização da Receita (Budget Stabilization Fund), including stochastic modeling software for portfolio analysis and risk management.

PARTNERS

-

Forum of Brazilian Sovereign Wealth Funds

-

Fundo de Equalização da Receita, Niterói, Brazil

-

Fundo Soberano do Estado do Espírito Santo, Brazil

-

Fundo Soberano de Maricá, Brazil

-

Fundo Soberano Municipal, Ilhabela, Brazil

-

Universidade Federal Fluminense

-

Fundação Euclides da Cunha, Niterói, Brazil

Featured Partners

Social Wealth Contributors

Adriel Araujo

Fellow

Andrea Gama

Affiliate Researcher

Francis Tseng

Lead Independent Researcher

Jason Windawi

Fellow

Jonathan Calenzani

Fellow

Paul Katz

VP and Lead Researcher

Sina Sinai

Research Associate

Thaís Donega

Fellow

Related Publication Series

Municipal Public Banking

Social Wealth Seminar

Recent Updates

Press Release: Mexico’s Petroleum Hedging Program as Counter-Cyclical Insurance

The Jain Family Institute released a new report assessing the remarkable petroleum hedging strategy that has been deployed for nearly...

Mexico’s Petroleum Hedging Program as Counter-Cyclical Insurance

A new report and modeling exercise point to the possible relevance of this successful petroleum hedging strategy to other exporting...

Brazilian Subnational Social Wealth Funds in Bloomberg and Washington Post

"Brazil’s Oil-Rich Cities Are Revolutionizing Its Public Wealth Management."

JFI’s public bank work in the Los Angeles Times

Los Angeles City Council has taken the next step towards a public bank.

Media coverage for JFI and the Berggruen Institute’s Municipal Public Banking research

NextCity covered the report's implications; the Los Angeles City Council has voted on next steps for implementation.

Event: We Take Mumbucas: Charting the Complementary Currency that’s Transforming a Brazilian City

A virtual event, Friday, June 30 from 1-2:30pm ET.

We Take Mumbucas: Charting the Complementary Currency That’s Transforming a Brazilian City

A new report by Andrea Gama and interactive visualization from Francis Tseng.

Part of the series Social Wealth Seminar

Press Release: Digital Complementary Currency Drives Revitalization of Brazilian City

Report and visualization offer first look at the impact of Maricá’s mumbuca, one of the most widely traded local...

JFI and Berggruen Institute Release Interactive Tool Exploring Impacts of a Public Bank

Digital web app allows anyone to build custom lending portfolios and see projected impacts on affordable housing, green energy, and...

Municipal Bank of LA: Interactive Balance Sheet Simulator

The simulator enables the public to allocate resources among the proposed public bank lending programs, testing cost and profit assumptions...

Part of the series Municipal Public Banking

Press release: People’s assemblies should govern public banks

A new report from JFI and the Berggruen Institute's Municipal Public Banking series

Municipal Bank of LA: Democratic Governance Frameworks

A briefing by Michael McCarthy of the Berggruen Institute on deliberative democracy for public finance and investment.

Part of the series Municipal Public Banking

JFI and Berggruen Institute Report: Public Bank Could Finance Over 17,000 Affordable Homes in Los Angeles

Press release: Latest in publication series on public banking shows how low-cost city programs can help protect and expand affordable...

Municipal Bank of LA: Housing Solutions and Portfolio Options

An analysis of how a public bank in Los Angeles could support the city’s broader infrastructure, housing, and sustainability...

Part of the series Municipal Public Banking

CBS covers JFI and Berggruen’s Public Banking report

On the first working paper in a series covering public banking in Los Angeles.

Press Release: JFI and Berggruen Institute Launch Series on Practical Pathways to Public Banking

Forthcoming publications lay out playbook for how a publicly-owned bank could unlock solutions to Los Angeles’ pressing challenges; new digital...

Launch of the Forum of Brazilian Sovereign Wealth Funds

The forum is a new association that invests in governance for a decarbonized future.

Press Release: The first technical seminar of the Forum of Brazilian Sovereign Wealth Funds

Researchers from the Jain Family Institute (JFI) and Brazil’s Federal Fluminense University (UFF) gathered with experts and government officials...

Social Wealth Seminar: Paul Williams and Zachary Marks

"Building a Future for Public Developers."

Part of the series Social Wealth Seminar

Presentation on A New Public Housing Model — Addis Ababa’s Urban Transformation

Join us on Friday, March 25 at 10am ET

A New Public Housing Model — Addis Ababa’s Urban Transformation

The first report from JFI's Social Wealth Portfolio

Social Wealth Fund work featured in Brazil’s O Globo

Coverage of the partnership between JFI, UFF, CEDE, and the government of the city of Niterói

Announcing a new partnership with the municipal sovereign wealth fund of Niterói, Brazil

JFI partners with the Municipal Treasury of the city of Niterói and the Federal Fluminense University to offer tools...

Universal Basic Income Workshop: Experiments, Policies, and Strategies

A two-day, online series of events and presentations on international basic income