Affiliate and Emerging Initiatives

We design and incubate affiliate initiatives brought to us by partners in government, industry, academia, and other sectors.

We offer research, logistical, and strategic support to our collaborators to foster an ecosystem of like-minded projects and organizations.

We are open to proposals for new affiliate initiatives. Find out more on our Partner With Us page, or email jfi@jainfamilyinstitute.org.

Affiliate initiatives

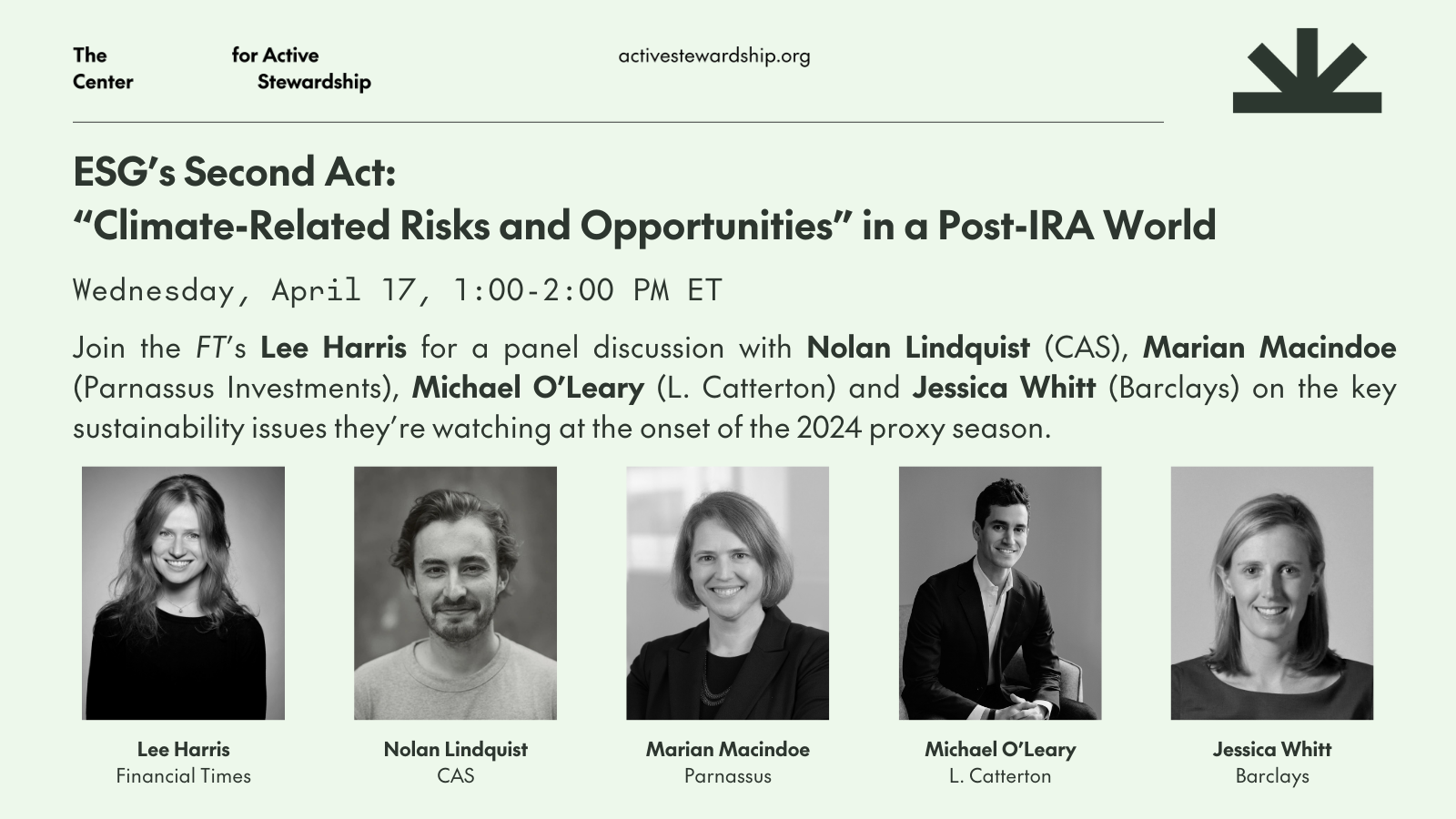

Center for Active Stewardship

Launched in 2022, the Center for Active Stewardship studies the relationship between the asset management industry and private sector action on climate change. Its first major project, a rating system of mutual funds and ETFs, highlights proxy voting as a mechanism for environmental action. A private philanthropist approached JFI with the Center’s theory of change, seeking our help with staffing, structure, research support, and strategic advice.

AI FOR THE PUBLIC GOOD

Emerging from JFI’s Digital Ethics initiative, with additional philanthropic support, this initiative focuses on unlocking the potential of AI for the common good. As a member of the UN-led Global Data Access Initiative (GDAI), we are developing a framework for the ready and ethically sound use of data for social and humanitarian needs. With the World Bank, among others, we advise on the ethical use of such data in AI systems in lower and middle-income countries.

Fund for Guaranteed Income

F4GI builds technology and infrastructure for governments and communities seeking to create guaranteed income programs. Founded in 2020 by Nika Soon-Shiong, F4GI leads the 800-recipient Compton Pledge, among other pilots. JFI incubated the organization and provided research, staffing, and strategic guidance.

The Strategic Decarbonization of the European Union

In partnership with the Atlantic Council, we are hosting a series of convenings and publishing a set of briefings on the challenges and opportunities of the energy transition in the EU. JFI fellows are leading research, framing, and policymaker outreach to build strategies for a future of sustainable and secure energy in Europe.

New Institute of Political Economy

Founded by Chris Hughes in 2021, NIPE is a research organization which focuses on macroeconomic policy, history, and law. JFI supports NIPE on operations and broad strategic support.

Areas of inquiry

JFI actively tracks dozens of research areas for future work. These are the current topics we find most promising.

JFI selects projects through a structured research process. We conduct initial exploration with a rubric, examining an idea from a variety of angles: its theoretical and empirical power; the degree to which it is foundational, innovative, and timely; the available intellectual and financial capital beyond our walls; and, finally, which of our own resources to bear–-our staff, fellows, and research base.

If you have a suggestion of a topic we should investigate, or a proposal for a collaboration on a topic below, please email jfi@jainfamilyinstitute.org.

macroeconomic research

We are interested in exploring economy-wide effects of fiscal and monetary policies, with a particular interest in their disparate impacts across demographic groups and geography. We are especially focused on the concept of “full employment”: how it is defined and why its achievement, despite being the ostensible goal of many levels of government, has been uneven and incomplete. Our initial efforts have focused on a possible interactive data dashboard and a new Heterogeneous Agent New Keynesian (HANK) model – both of which we see as tools for in-depth collaboration.

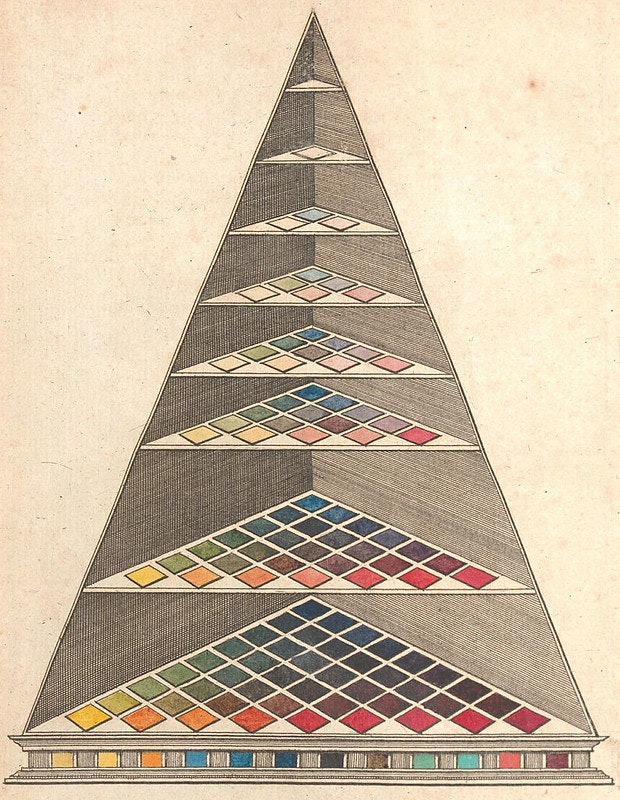

Economic, Social, and Governance Scoring

An increasing number of businesses and asset managers are incorporating economic, social, and governance (ESG) factors into their decision-making. ESG factors rely on data, however, much of which is currently decentralized and based upon voluntary disclosures; investors and advisory also process such data in markedly different ways. Despite good faith efforts by ratings agencies and auditors, a new approach is still needed to bring alignment to the field. One possible intervention that interests us is a scoring system that might allow corporations or funds to offset their investment in non-ESG funds.

CLIMATE CHANGE MITIGATION

While international governments have made significant strides in coordinating emissions reductions, there remains significant risk that the global community will fail to hit the targets needed to limit global warming by next century. Attention has increasingly shifted towards technology-enabled climate mitigation strategies, among them carbon capture and solar radiation modification (SRM), aka “geoengineering”. Recognizing that it is likely inevitable that companies, governments, or entrepreneurial actors may turn to such solutions, we are interested in building an ethical and governance framework that helps enable meaningful global coordination to ensure climate mitigation efforts are undertaken responsibly, justly, and without coming at the expense of emissions cuts and clean energy development.

Tax efficiency and fairness

There is broad agreement that the US is struggling to efficiently and effectively secure the funding for its future – whether for servicing existing debt obligations, or for funding needed social and infrastructure investments. Debates continue over new taxes (on wealth, inheritance, VAT), as well as over IRS enforcement. We are interested in identifying possible efficiencies and opportunities for greater fairness within the existing tax framework that might be amenable to practical reform – and avoid the political polarization that tends to surround the issue.

CRIMINAL JUSTICE REFORM

Even as federal and state governments make strides in reforms to policing and sentencing, the efficacy of the US correctional system has attracted less meaningful attention. That concerns us, since, by any reasonable measure, our prisons are failing in their taxpayer-funded mission to rehabilitate; recidivism rates remain stubbornly high and conditions stubbornly poor. With experts in the space, we are beginning to explore rehabilitation models and incentive structures with an eye towards systemic reform.

Recent Updates

Panel April 17: ESG’s Second Act: “Climate-Related Risks and Opportunities” After the IRA

Exploring the disconnect between NGO priorities and how investors in public and private markets are analyzing "climate-related risks and opportunities"

Center for Active Stewardship in the Financial Times

Alphaville's Further Reading shares several posts by CAS executive director Nolan Lindquist.

JFI Researchers Meet with LA Leaders to Discuss Public Bank Options

JFI and Berggruen Institute researchers met over three days with political and civic leaders across Los Angeles to discuss the...

Atlantic Council policy memo: “How to strike a grand bargain on EU nuclear energy policy”

JFI fellows Jonah Allen and Théophile Pouget-Abadie are co-authors on this policy memo as part of our affiliate initiative...

Atlantic Council policy memo: “A NATO-style spending target could fund long-term decarbonization”

JFI fellow Théophile Pouget-Abadie wrote this memo as part of our affiliate initiative with the Atlantic Council.

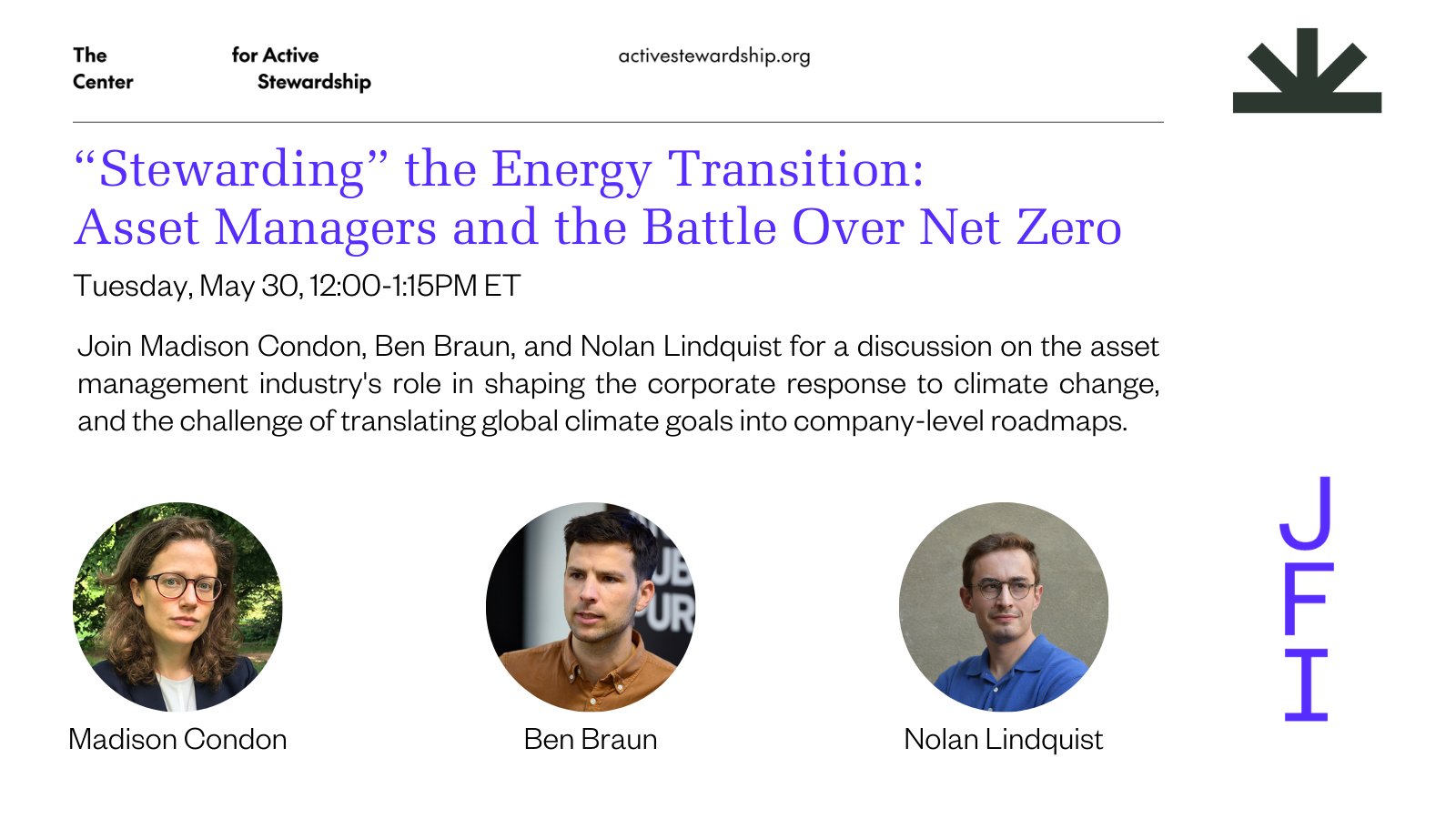

“Stewarding” the Energy Transition: A Discussion

A discussion with Madison Condon and Benjamin Braun on how the asset management industry is approaching climate change.

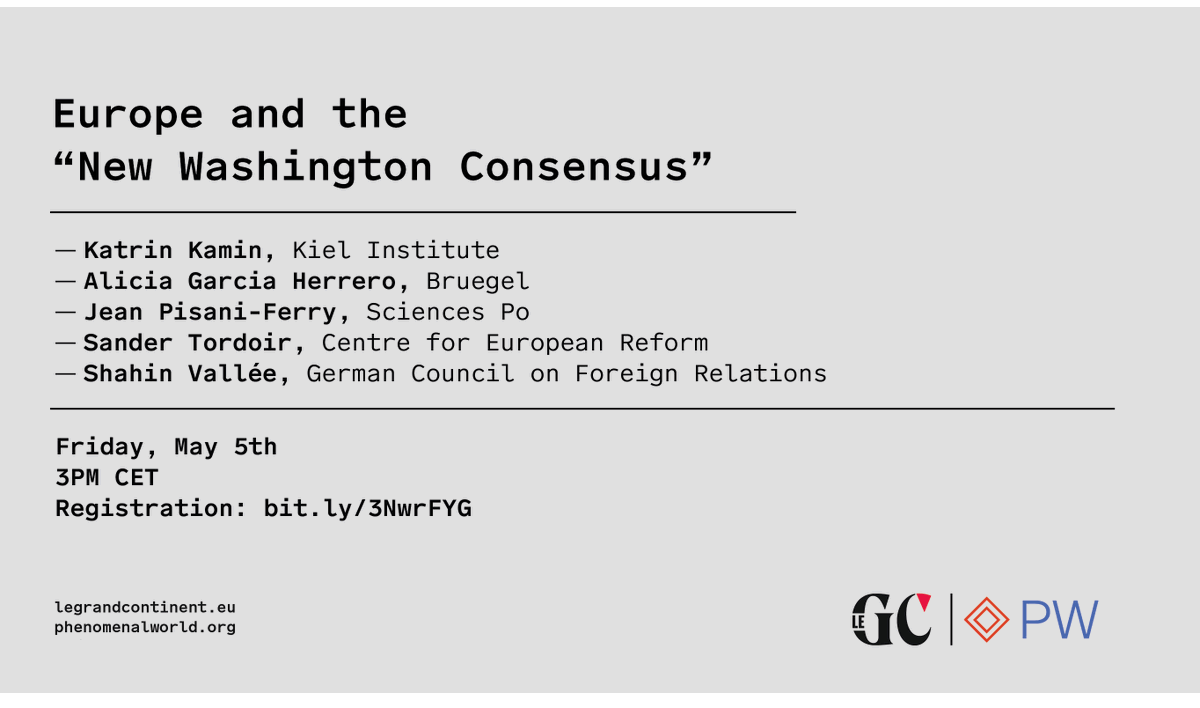

Discussion: Europe and the “New Washington Consensus”

A discussion on Europe and the Inflation Reduction Act, hosted by Le Grand Continent and Phenomenal World.

Atlantic Council brief: “Clean industrial policies: A space for EU-US collaboration”

JFI fellows Jonah Allen and Théophile Pouget-Abadie wrote this brief as part of our affiliate initiative with the Atlantic...

New paper: Exploring Data as and in Service of the Public Good

Co-authored by the Digital Public Goods Alliance (DPGA), Global Partnership for Sustainable Development Data, Jain Family Institute, UN Global Pulse,...

Welcoming two fellows on European decarbonization

The fellows join our affiliate initiative with the Atlantic Council.

Claudia Sahm at the National Association of Business Economics

NABE's 38th annual economic policy conference

Anton Korinek: Aligning AI with Society’s Values

JFI Research Session with Professor Anton Korinek, drawing on his work on AI systems and governance

Friederike Schuur on Data Networks for UN Global Pulse

Schuur, a joint fellow with JFI and United Nations Global Pulse, provides an overview of her research

“Combating Inequality”: JFI Executive Director Michael Stynes publishes paper with Larry Katz and Jesse Rothstein

The paper is a chapter in the new MIT Press book edited by Olivier Blanchard and Dani Rodrik

JFI Fellow Mike Pizzi writes on artifical intelligence governance at the United Nations

Co-authored with Mila Romanoff, the piece provides an overview of AI governance at UN Global Pulse

JFI co-hosts international roundtable on AI governance with UNESCO, Future Society

Along with several major research, policy, and legal organizations, JFI digital ethics researchers convened for the 2nd annual Athens Roundtable...

JFI offers expert perspective on AI and criminal justice for NJC

JFI Digital Ethics and Governance Fellow Lily Hu spoke on a National Judicial College panel discussing AI and criminal justice

Thea Riofrancos

Speaking to her newly-published book, Resource Radicals: From Petro-Nationalism to Post-Extractivism in Ecuador, Riofrancos discussed the results of almost a...

JFI Capital Launches

How to support JFI's projects

Max Kasy

JFI's virtual research session with Max Kasy, Associate Professor at Oxford, discussing fairness in algorithmic decision-making.

Inside Out: A Conversation

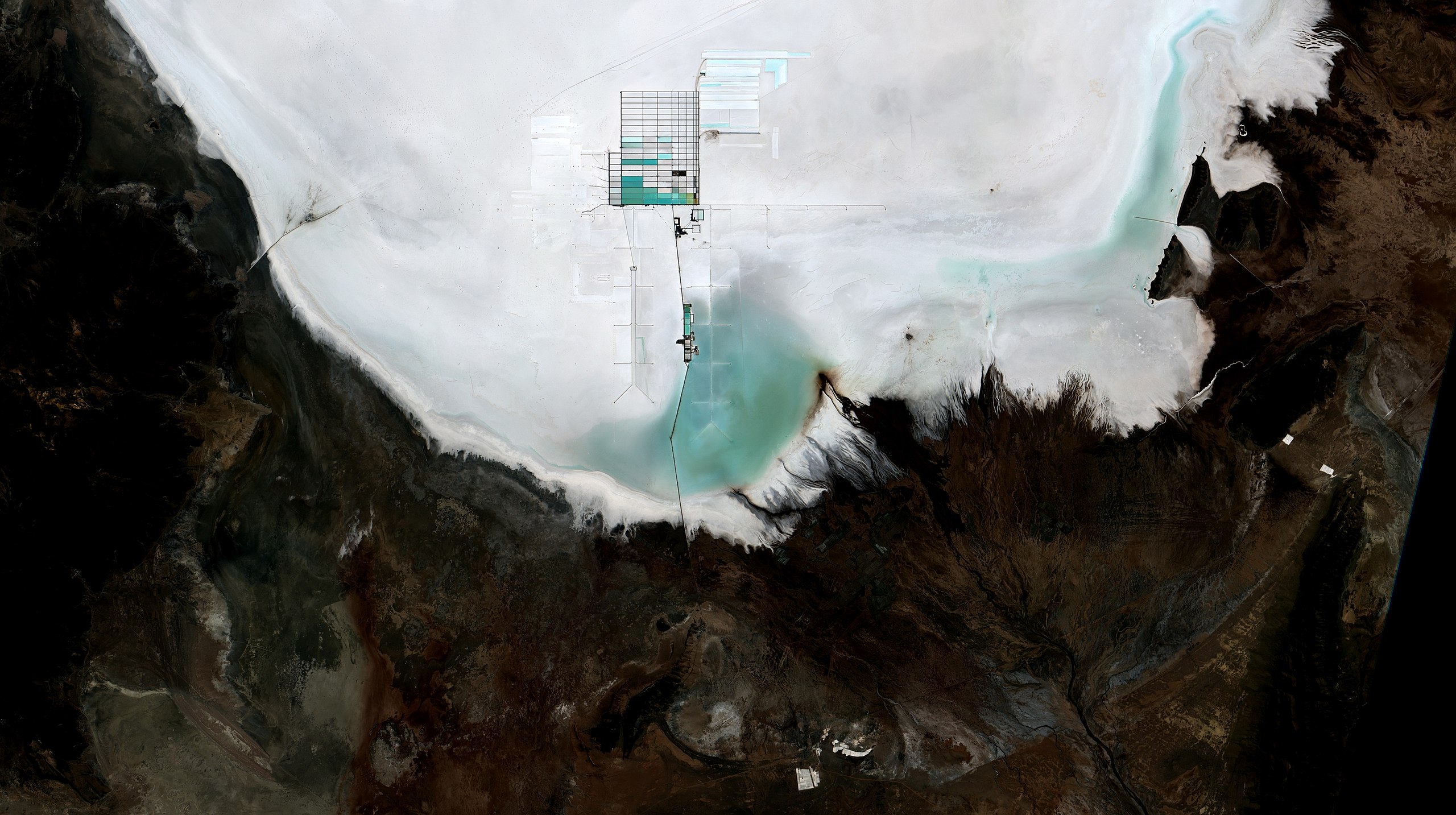

A live Twitter conversation between experts and advocates in renewable energy, economics, geology, indigenous rights, land rights, and related issues.

Part of the series Inside Out: Mining and Renewable Energy

Experts & advocates on renewable energy, mining, land rights discuss JFI’s report on mining

Our Live #JFIMiningChat on Twitter shed new light on Green New Deal legislation and the practical and ethical questions related...

JFI’s Arden Ali presents on digital ethics to the American Bar Association

JFI Lead Researcher in Digital Ethics & Governance, Arden Ali, spoke on a panel for the ABA International Law Section, discussing...

Inside Out: A Webinar

On May 20, 2020, JFI hosted a virtual briefing on a report on renewable energy, the future of mining, and the re-localization...

Part of the series Inside Out: Mining and Renewable Energy

Press Release: Inside Out, new report on renewable energy and the future of mining

JFI Lead Independent Researcher Francis Tseng provides a comprehensive survey of transitions to renewable energy infrastructure and the myriad harms...

Gernot Wagner

Author of "Climate Shock" and NYU associate professor of environmental studies and public service, Gernot Wagner joined JFI for a...

Live Twitter chat – free higher ed, austerity, & other histories from Kim Phillips-Fein

JFI hosted five historians and economists for a live Twitter chat about free higher ed, austerity, the New Deal, and...

Call for Abstracts: MIT x JFI workshop on algorithmic ethics

JFI and the MIT Schwarzman College of Computing are hosting a workshop this April on the ethics of algorithms.

Alyssa Battistoni

Harvard Environmental Fellow and political theorist Alyssa Battistoni presented on her new book, "A Planet to Win: Why We Need...

JFI researchers at UN Global Pulse discussions in Geneva

JFI Digital Ethics Project Lead, Arden Ali, and JFI Research Fellow Michael Pizzi participate in UN Global Pulse discussions on...

AI and the rule of law

JFI attended the inaugural roundtable in Athens

An overview of our summer social mobility seminar, hosted by Briane Cornish-Knight

JFI's inaugural six-part seminar

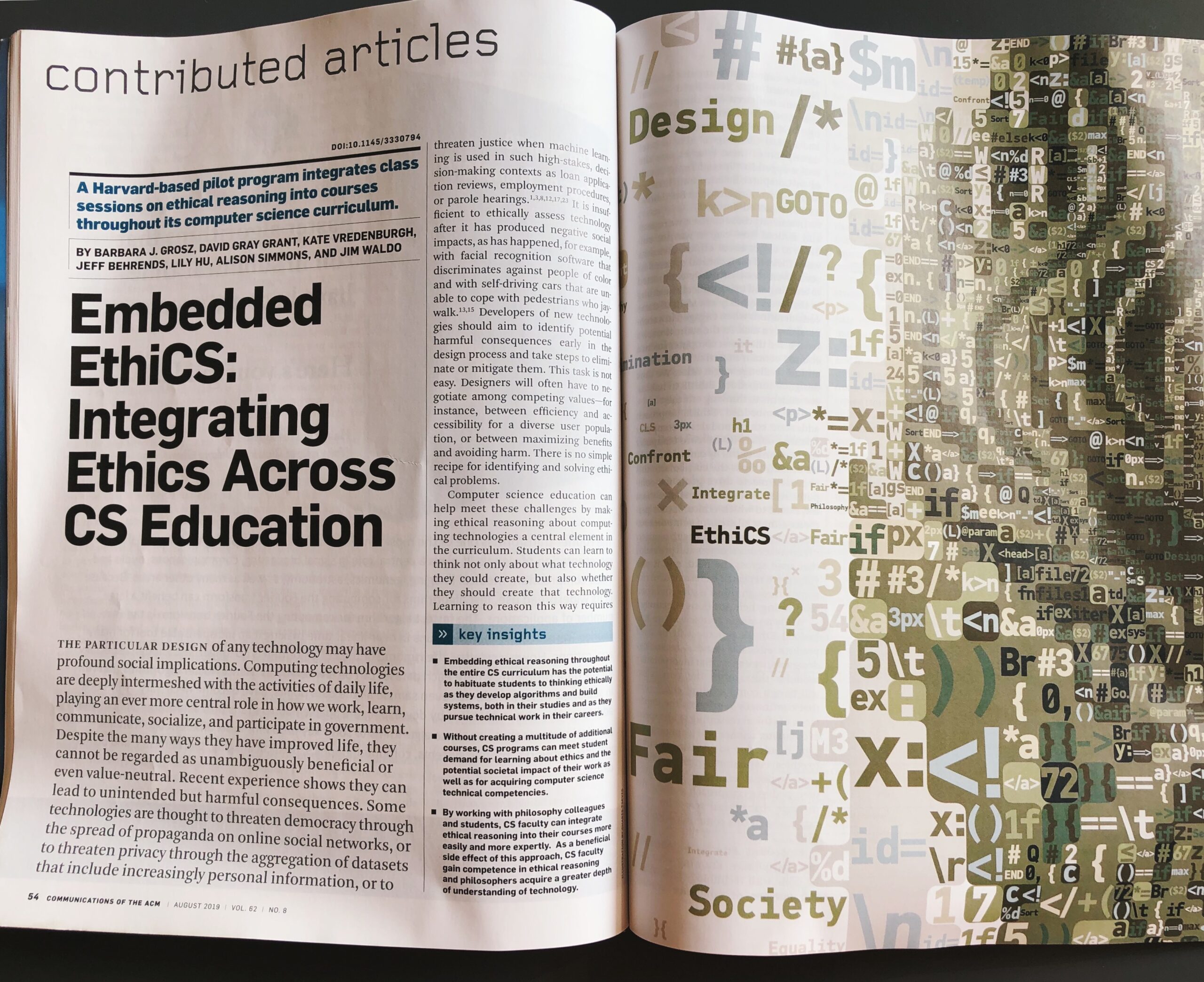

Article: Embedded EthiCS: Integrating Ethics Across CS Education

The August 2019 cover story of the Communications of the ACM is co-authored by JFI fellows David Gray Grant and Lily...

Kathryn Holston

Holston presented on the current state of macroeconomic modeling

Research Session with Arden Ali

Ali presented on ethical considerations for artificial intelligence

A new website on algorithmic decision-making systems in New York

The site is a Harvard Kennedy School capstone project created in partnership with JFI

Workshop in Ethical Engineering

A new MIT course taught by JFI fellows