Policy Microsimulations

The Expanded Child Tax Credit and Parental Employment: Tenuous Evidence Points to Work Disincentives

By Jack Landry, Research Associate1For questions, reach the author at: jack.landry@jainfamilyinstitute.org. Halah Ahmad, Elaine Maag, Stephen Nuñez, Claudia Sahm and Molly Dektar provided exceptionally helpful comments.

Download the full PDF here for best reading experience.

Executive Summary

The 2021 expansion of the Child Tax Credit represented a sea change in the U.S safety net. The expanded credit has no minimum income or work requirement, so millions of low-income children excluded by the prior credit’s structure are newly eligible for benefits. Early research has found that these changes caused a historic reduction in child poverty, as well as large reductions in food insufficiency and financial stress.

However, some academics and policymakers have argued that the benefits of the expanded credit must be weighed against its potential to disincentivize work. Since the first CTC checks were distributed in July, there has been no evidence of a decline in parental employment. Nevertheless, they worry that in the long run, a permanent expanded credit would inevitably cause parents to drop out of the labor force, which in turn would reduce the poverty-fighting power of the credit. The academic centerpiece upholding this argument comes from a team of economists from the University of Chicago. They estimate that a permanent expanded credit would cause 1.5 million parents to quit working, and, after accounting for that job and therefore income loss, dilute the anti-poverty impact of the expanded credit by more than a third and completely eliminate any reduction in deep poverty.

This brief critically assesses the argument that a permanent, expanded Child Tax Credit will cause a significant number of parents to drop out of the labor force and dampen its anti-poverty impact. It shows that both empirical evidence and basic intuition points to parents staying in the labor force. While the focus is on investigating the paper by the University of Chicago team, most of the findings prove relevant to several other analyses that predict even modest CTC-related job losses. When subject to scrutiny, evidence predicting significant job loss is extremely thin.

The brief begins by opening up the black box of the University of Chicago team’s complex microsimulation model to show their predictions of widespread job quitting strain credulity. For instance, according to their model, 11 percent of single mothers with two children making $30,000 per year in income would quit working. These families could not replace their labor income with a $6,000 Child Tax Credit—they would voluntarily be choosing a drastic reduction in living standards—often moving from significantly above the poverty line into deep poverty. Importantly, the University of Chicago team does not predict parents will reduce how much they work in response to the credit—all the job loss comes from parents dropping out of the labor force entirely.

Second, the brief reviews the literature on which the University of Chicago team bases its predictions of widespread quitting—employment responses associated with the Earned Income Tax Credit (EITC). The EITC gives a significant tax bonus to low-income families with children who work, and some research has argued that the availability of this tax bonus has caused more single parents to join the labor force. They argue that if you believe the EITC increases work, you have to believe eliminating the prior CTC phase-in structure—which operates similarly to the EITC—will cause proportionate decreases in working. However, recent research casts doubt on the finding that EITC increases employment at all. Of the five federal EITC expansions, only one coincides with a robust increase in employment, and changes in that period (the mid-90s) are likely better explained by welfare reform than the EITC.

Third, the brief shows that even if the EITC increases employment, it takes several additional tenuous assumptions to expect a proportional decrease in employment from the redesigned CTC. EITC research purports to show single mothers join the workforce in response to a larger tax bonus for working; yet, researchers cannot assume a proportional decrease in labor force participation when the expanded CTC decreases the tax bonus for working. Leaving the workforce would mean accepting a dramatic decline in income and living standards, thus it may be far less responsive to tax incentives than entering the workforce. Moreover, the Trump-era CTC benefits workers at higher income levels than the EITC, and higher-income families may be less responsive to that change in the return on work because they have more income to lose from dropping out of the labor force.

Breaking Down the Assumptions of the University of Chicago Study

The key to understanding why the University of Chicago team believes over a million parents will quit their jobs lies in something called the “return-to-work.” The Biden Child Tax Credit gives most parents the same benefit regardless of how much they work.2The expanded credit initially phases out at $112,500 for single parents and $150,000 for married parents, then fully begins to phase out at $200,000 for single parents and $400,000 for married parents. In contrast, the old CTC under the Tax Cuts and Jobs Act (TCJA) phased in as incomes increased, so parents got a larger total tax refund the more they worked. While most parents get more total benefits under Biden, there is no additional CTC benefit for working. To the University of Chicago team, reducing the bonus for working under the Biden credit compared to the Trump credit is an important enough work disincentive to cause 1.5 million parents to quit their jobs. Prior to the University of Chicago team’s study, analyses focused on the potential employment disincentive effects from the CTC increasing families’ total incomes—not the change in families’ CTC benefits for working.

Figure 1 shows how this reduction in the return-to-work functions for a single parent with two kids (most assumed job loss comes from single parents, so the brief focuses on that group). The horizontal axis shows how much the parent is paid from their job(s), the vertical axis shows how much money they take home after taxes, including the Child Tax Credit. The light blue solid line represents policy under the Biden Child Tax Credit, and the dark blue dotted line represents policy under the old Tax Cuts and Jobs Act (TCJA) Credit under President Trump. While the graph makes it clear that parents get more total benefits under the Biden credit (especially at low incomes), the TCJA line also increases at a slightly steeper pace between $2,500 and $30,000, as parents get a larger CTC credit the more they work. The slight flattening of the relationship between pre-tax and post-tax income under the Biden Child Tax Credit is barely perceptible in the graph,3Appendix Figure 1 zooms in between $0-$30,000 in earnings where there is a difference in slopes. but it functions as the critical work disincentive (decrease in the “return-to-work”) within the University of Chicago team’s model.

Figure 1

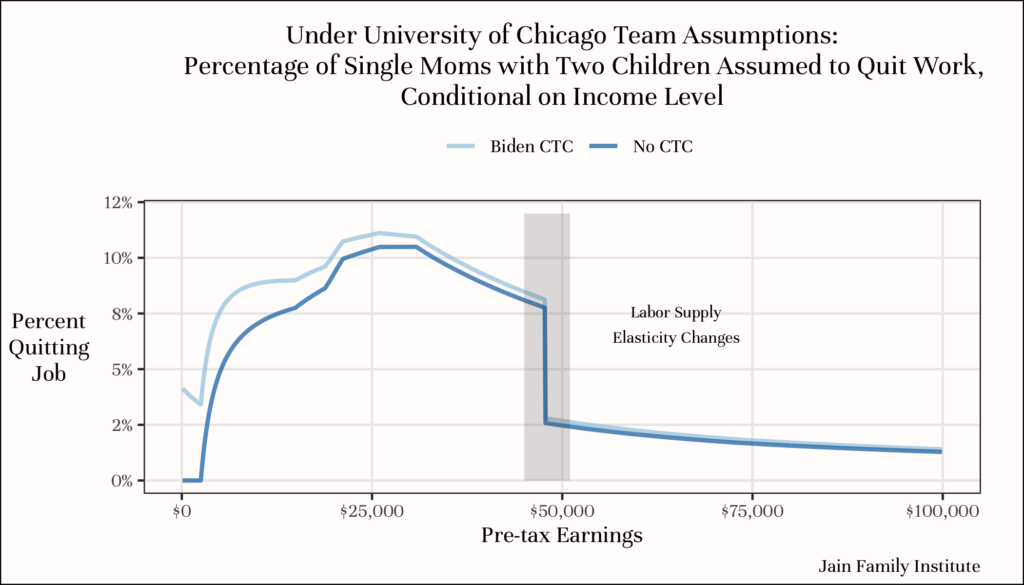

Figure 2 shows exactly how important the decrease in the return-to-work is for parents’ decision about whether to quit working according to the University of Chicago team’s model.4I continue to focus on single parents because the majority of job loss comes from that group. While the tax schedule is the same for single moms and dads (Figure 1), the University of Chicago team’s model predicts higher rates of leaving the workforce for single moms (Figure 2) than single dads. Their appendix shows the number of parents that would quit their job by income level. However, it is hard to understand how commonly they assume the moderate-income single parents will quit their jobs because they don’t break down this quantity by family type (job losses are concentrated among single parents, where they use the 0.75 elasticity rather than 0.25) and the percentage of parents, rather than the absolute number, who they predict will quit their jobs. The figure takes a hypothetical single mother with two children, calculates the decrease in their return-to-work from the expanded Child Tax Credit at different levels of earnings, and then translates that quantity to the predicted fraction of parents that would quit their job using the University of Chicago team’s model (more detail on the calculations is available in the Appendix).5The same figure for one to four children is Appendix Figure 2. Predicted job quitting rates are higher with more children and even more concentrated at higher income levels. For example, the graph shows they predict 11 percent of mothers making $30,000 per year would quit working altogether in favor of the $300 per child, per month benefit (that they would also receive if they continued to work).6The abrupt dropoff in job quitting at around $50,000 of income results from the University of Chicago team assuming a much smaller labor supply response when parents are no longer eligible for the EITC, a point I will return to in the third section. The highest probability of leaving the workforce in the paper’s model comes when the TJCA CTC is fully phased in, which for single parents with two children comes at around $30,000 of income.

Figure 2

There are several reasons why this model of single mothers’ job quitting seems implausible. First, the change in the incentive to work (shown in Figure 1) is relatively subtle. The tax code is complex; it is unclear if parents understand how the Biden Child Tax Credit changes after-tax income for different levels of earnings.7Section three makes this point in more detail. Likewise, even if parents have a good understanding of the change in their hypothetical tax structure, it is hard to imagine such a large fraction of parents would respond to this small change in benefits by leaving the workforce entirely.

Second, their model produces high rates of leaving the workforce at relatively moderate income levels. Figure 2 shows their highest predicted rates of job quitting (11 percent) comes between $21,000-$32,000 of pre tax income. These parents would receive just $6,000 from the expanded Child Tax Credit (a sum they would also be eligible for if they continued to work).8The University of Chicago team assumes that all parents quitting their jobs would get the maximum SNAP benefit conditional on their family size in addition to the Child Tax Credit. Even with this benefit, most families would be facing a large drop in total household income. Quitting working at this level of earnings entails a drastic drop in total income and associated living standards.9Some parents may live with other household members who can buttress their income loss from quitting their job. The brief considers the implications of this fact for the University of Chicago team’s poverty calculations in the appendix. Early discussion about the University of Chicago paper pointed out the implausibility of their assumptions that many high-income parents will quit working because of the Biden CTC. Over a quarter of the University of Chicago team’s forecasted employment losses come from parents making over $50,000 per year. While quitting work at these levels of income seems well out of the range of plausibility, Figure 2 also shows that the University of Chicago team assumes very high rates of single parents leaving the labor force with moderate incomes that also strain credulity. Married parents have lower predicted rates of job quitting, but quitting is even more concentrated at high incomes than for single parents in their model (shown in Appendix Figure 3).

Third, the University of Chicago team does not predict that parents will reduce how much they work by switching to part-time or cutting back on their hours—all the decrease in work comes from parents exiting the labor force entirely.10The University of Chicago team argues that omitting any intensive margin effect is a conservative assumption offset by other unrealistic parts of their model that this brief does not detail (among married parents who quit working, they always assume both parents quit, rather than one parent). If they allowed for intensive margin effects (without making any other changes), poverty would rise even more. However, the contention that omitting intensive margin effects is conservative is inconsistent with most research, which finds minimal intensive margin effects from changes in the tax code that increase the return-to-work. This illustrates exactly why they find a diminished poverty impact of the Biden CTC. Essentially, families in poverty play musical chairs with families who are currently well above the poverty line. In the University of Chicago team’s model, many low-income parents will be lifted above the poverty line from the Biden CTC; the diminished poverty impact comes from another set of parents, many of whom are currently above the poverty line, who they predict will quit work and consign themselves to poverty (even deep poverty) because they get a smaller tax bonus for working.

Fourth, the key disemployment effect in the University of Chicago team’s model is decreasing parents’ tax refund bonus from working—not the extra income from the Child Tax Credit. While the decrease in the return-to-work under the Biden CTC is subtle, Figure 1 clearly shows the expanded credit gives more benefits to parents with no income. Popular perception of the CTC’s employment effects identifies this increase as an important work disincentive. However, the increase in income unconnected to work is not what drives the University of Chicago team’s findings of widespread job quitting. In modeling this “income effect,” the team follows the large body of research that has found that people largely continue working when given a lump sum income benefit. The important disemployment effect causing widespread job quitting in their model is the slightly steeper relationship between pre- and post-tax income under the TCJA CTC than the Biden CTC (a decreased “return-to-work”) shown in Figure 1.

In fact, the focus on the decreased “return-to-work” means the University of Chicago team’s methodology would find very similar employment losses if the CTC was eliminated rather than replaced with the Biden CTC. Figure 3 highlights this point by comparing the percentage of parents that would quit their job under the Biden plan versus simply eliminating the Child Tax Credit using the University of Chicago team’s methodology. Assessing the plausibility of the team’s assumptions about widespread job quitting entirely depends on the plausibility that single parents who earn a significant amount in the labor market will quit their jobs because they get a roughly 15% or smaller tax bonus from their work.

Figure 3

Revisiting Large Increases in Working in the EITC Literature

Clarifying the University of Chicago team’s assumptions about which parents they predict will drop out of the workforce provides an important check on the credibility of their results. Even simple applications of economic models can often lead to nonsensical results; in this case, the University of Chicago model spits out suspect predictions that over a million parents will give up working and even consign themselves to poverty due to the expanded CTC. However, researchers should not solely judge plausibility based on their intuitions about human behavior.

In fact, the University of Chicago team does not pull their estimates about large-scale job losses from thin air. Their predictions, though outliers, are based on a significant body of research showing that expansions of the EITC cause single mothers to enter the workforce by providing a significant tax bonus for working (increasing the “return-to-work”). As previously noted, their predictions come from extrapolating that EITC research to the CTC. Other analyses of job quitting from the expanded CTC also draw on EITC research, though those researchers believe it implies less responsiveness than the University of Chicago team. Before the Biden expansion, the CTC did operate similarly to the EITC. If parents did not earn income, they did not get any benefit. As parents started to work and had a substantial taxable income, they would get a larger and larger benefit, maxing out at $2,000 per child. The foundation of the University of Chicago team’s argument is that if the EITC increases labor force participation, then redesigning the CTC to give all low-income parents benefits regardless of levels of work must cause a significant number of parents to quit their jobs.

Even if one agrees with this extrapolation of EITC data (a point this brief challenges in the next section), researchers may need to reassess the strength of evidence around its positive employment effects. A sizable body of research has found that expansions of the EITC have caused a substantial fraction of single mothers to join the labor force. However, a recent paper from Princeton economics professor Henrick Kleven suggests that this literature stands on shaky ground.11Kleven’s results apply to the employment effects of the EITC. Impacts of the EITC on other domains (e.g. health) do not depend on the EITC increasing employment. For instance, the EITC could improve low-income parents’ health simply by giving them more money. If the EITC does not increase employment, it makes a stronger case that the CTC will have long-term positive effects on parents and children since it rules out the parental employment channel as the causal agent behind research identifying the many positive impacts of the EITC on parents and their children. While this single paper goes up against most findings on the EITC and labor force participation, its critiques apply broadly and are quite persuasive.12Readers familiar with Kleven’s paper should note that an updated draft from November 2021 responds to the early rebuttals and provides all the code and data required to replicate the results. This brief summarizes Kleven’s main points but does not provide a comprehensive summary.

Almost all the research about the EITC is observational,13Notably, the few randomized evaluations of the EITC less vulnerable to criticism about confounding have found no significant employment effects. One study expanding the EITC for singles without children found small, non-significant employment effects. Another randomized experiment teaching tax filers about the earnings incentives of the EITC (but not directly modifying the benefit) also found no effects on earnings or employment. testing the differences in employment rates of single women with children (who are eligible for the EITC) compared to single women without children (who are not eligible for most of the EITC) before and after an expansion of the EITC.14Research on the EITC also identifies policy impacts by study expansions that give a larger boost to women with a certain number of children. Married couples are eligible for the EITC, but their incentives for work are complicated by their dual-earner structure. Some research points to small reductions in hours worked from married women in response to the credit. While this methodology is relatively simple, there are many different decisions researchers have to make in practice, including what expansion of the EITC to study, what data to use, and what other variables to control for, among many others. In Kleven’s revaluation of the EITC literature, he shows that only one expansion of the EITC (in 1993) is associated with an increase in employment among mothers with children. The other four federal EITC expansions only show an employment response if researchers use a handful of specific combinations of data and control variables—outliers among all the potential specifications the researchers could have chosen. In sum, the only robust evidence of employment increases after an increase in EITC benefits comes from the 1993 expansion, and averaging the effects of all the expansions together shows no increase in employment.

Kleven goes on to question the purported employment effect of the 1993 EITC expansion, which coincided with huge changes in the welfare system, cultural attitudes about mothers’ work, skyrocketing incarceration rates, and a booming economy. All of these factors could have caused a disproportionate increase in single mothers’ employment, which makes isolating the effect of the EITC difficult. Kleven shows that even if we assume the EITC causes a large employment response (in line with the significant labor market response assumed by the University of Chicago team), it could only explain a small fraction (roughly 30%) of the employment growth of single mothers after 1993. This means that for researchers to convincingly isolate the effects of the EITC on employment, they must put faith in precisely controlling for all the other factors that could be causing increases in single mothers’ employment at this time. After Kleven partials out the effects of welfare reform, he finds the EITC does not significantly affect employment. However, with so many changes causing such a large impact on employment in this period, no natural experiment can convincingly isolate the effect of the EITC by design. Finally, while employment for all single mothers sharply increased after the EITC reform, the pattern of increases do not map onto the structure of the EITC incentives: The highest employment increase was among single mothers with three or more children, but EITC expansions were limited to single mothers with one or two children.

The University of Chicago team does acknowledge the Kleven paper. They argue that even if you believe its findings, the Biden CTC expansion is similar to undoing the 1990s welfare reform that eliminated unconditionality from federal benefits—and thus should produce large numbers of parents quitting their jobs regardless of the precise mechanism. The Biden CTC does provide cash support to parents without gainful employment or verifiable income, a benefit that was broadly curtailed during welfare reform. However, the critical difference between the pre-welfare reform support for single mothers (Aid to Families with Dependent Children, or AFDC) and the Biden CTC is that AFDC had tremendously high work disincentives, sometimes taking away as much as $1 in benefit for every $1 increase in income (this is acknowledged by the University of Chicago team in a footnote) In contrast, the Biden CTC is work neutral,15The prior CTC structure may have helped compensate families enrolled in other in-kind welfare programs who lose benefits as their income increases. However, since tax refunds come once a year and families are uncertain about how much they’ll receive, they do not think of refunds as a buffer against the loss of other welfare programs. providing the same benefits to most parents regardless of how much they work.16Arguably, providing basic cash support to families with no earned income is a critical benefit of the Biden CTC that reverses historic harms of welfare reform. The credit’s work-neutral structure ensures it does not repeat the shortcomings of the ADFC program. Many parents receiving AFDC wanted to work, but it made no economic sense as they would have to pay for childcare and lose the bulk of their benefits.

If Kleven is correct that employment is not significantly affected by modest changes in the tax bonus for working, the only other mechanism that could produce large employment effects from the expanded CTC is an income effect. The University of Chicago team explicitly models the “income effect” and finds it has a minimal effect on employment–causing just 114,000 parents to give up working. Analogies to welfare reform are therefore not relevant.

Comparing the Earned Income Tax Credit to the new Child Tax Credit

For those still convinced that the EITC substantially increases labor force participation, there remain reasons to be skeptical that the redesign of the Child Tax Credit will cause a significant number of parents to quit their jobs. The University of Chicago paper and surrounding conservative commentary have focused on the alleged hypocrisy of believing that expanding the EITC increases labor force participation while arguing that Biden’s redesigned Child Tax Credit will not significantly change parents’ attachment to the labor force. In particular, a widely cited National Academies of Science report argued that a child allowance very similar to Biden’s CTC would have a minimal employment effect, while an expansion of the Earned Income Tax Credit will cause a substantial number of mothers (almost 800,000) to join the workforce. Some conservative scholars have suggested the only viable paths forward for the NAS committee is to disown their analysis of the EITC expansion or admit they made an error in forecasting minimal employment changes from reforming the Trump-era CTC into a child allowance-like policy. Contrary to these claims, it requires several additional tenuous assumptions to apply research about increases in labor force participation from the EITC to predict widespread job quitting from the expanded CTC.

First, EITC research purports to show that increasing the “return-to-work” causes more single parents to join the workforce—the University of Chicago team extrapolates this to assume a decrease in the “return-to-work” will cause parents to quit the workforce.[fnThe University of Chicago team acknowledges this is an assumption, but does not discuss its plausibility.[/fn] Social science research is littered with examples where this kind of symmetry of effects does not hold. As emphasized in section one, parents may be extremely adverse to voluntarily accepting the large decline in income and living standards that comes with quitting working, and EITC research does not provide any direct support for predictions about parents leaving the workforce.17The only paper the University of Chicago team cites that finds a decrease in labor force participation in response to losing eligibility for the CTC has extremely wide confidence intervals around its estimates that do not rule out any employment decline and uses methods that are inappropriate for a rounded running variable (birth month) in a regression discontinuity design. Deciding whether to enter the workforce or increase hours is likely a very different calculus than deciding whether to quit working, such that tax incentives like the EITC that increase the “return-to-work” may be effective.18Of course, employment is dynamic over time, and many new mothers temporarily leave the workforce after having children. However, having a child is correlated with many other life events, namely marriage, such that leaving the workforce does not necessitate a drop in total household income.

Second, the CTC has important structural differences from the EITC. EITC benefits are concentrated among low-wage workers and were explicitly designed to encourage parents with low earnings potential to enter the labor force. In contrast, before Biden’s redesign of the CTC, the credit was centered around supporting middle-class parents with the cost of raising children. Under President Trump, the credit was revised to benefit married parents with incomes up to $400,000.

The upshot of these design differences is that Biden’s expanded CTC decreases the incentive to work primarily for moderate-income parents, while the EITC increases the incentive for non-working parents to join the workforce but make a relatively low income.19For single parents with two children, the largest decrease in the return-to-work under the redesigned CTC occurs at $31,000 or earnings, while the return to work under the EITC maximizes at $15,000 of earnings. The differences in the design and the variation of the return-to-work by income level between the CTC and the EITC are acknowledged by the University of Chicago team (see figure 3 in their paper), but they do not discuss how this may affect the plausibility of their estimates. It is likely that switching from not working to making a relatively small amount of income is more influenced by tax incentives than switching between making a moderate working-class income to quitting work altogether.

In fact, the University of Chicago team assumes a much lower rate of giving up work in response to a given change in the return-to-work for higher-income single parents outside of eligibility for any EITC benefit (see the sudden decline in predicted job quitting in Figure 1 around $50,000). This methodological choice implicitly acknowledges that it does not make sense for higher-income parents to have the same probability of quitting their jobs for a given decrease in the return-to-work as lower-income parents. However, reducing the amount of employment response only after roughly ~$50,000 of income exaggerates the employment response even if the EITC substantially increases employment. Third, simple application of labor elasticity estimates from EITC research does not account for a potentially larger general equilibrium response to the expanded Child Tax Credit that can counteract any work-disincentive effects. The EITC concentrates its benefits on low-income families, while the expanded CTC gives benefits well up the income distribution and provides a larger total transfer. Since historic EITC expansions have been much smaller than the CTC expansion, any effects from this larger total transfer would not be captured in EITC research. However, the sheer size of the expanded CTC should provide a significant boost to consumer spending, which can create jobs and increase wages. If a decrease in the tax bonus for working decreases labor force participation, the same logic demands that job and wage growth (particularly at the bottom of the distribution) should increase labor force participation.20Because wages and job availability are far more observable and salient than changes in the tax code, there is a case that parents would respond more to increased wages than an equivalent income boost from changes in changes in the tax code. Therefore, applying a labor supply elasticity to a change in the tax code without incorporating any other factors that conflate or dampen such effects on employment can provide an incomplete and even misleading picture.

Finally, any disemployment response from the expanded CTC requires households to have more detailed knowledge of the tax code than employment responses to the EITC. Though the EITC was first implemented almost five decades ago, survey research has found that many low-income families are not even aware of its existence, let alone the precise levels of income that maximize benefits. Researchers often argue that this lack of knowledge helps explain the lack of an intensive margin response to the EITC (usually variation in the number of hours worked to maximize EITC benefits) because that would require detailed knowledge of the precise EITC structure. However, researchers argue that responses on the extensive margin (working versus not working at all) requires minimal knowledge of the EITC, only that you can get a large tax refund for working.

This same logic cannot predict large scale job losses from the expanded Child Tax Credit. Just like EITC expansions, the Biden CTC expansion made tax refunds larger for low-income families. The key potential disemployment effect comes from extending full eligibility to families with no labor income, which reduced the additional refund households would receive from working relative to not working. However, knowing that the “return-to-work” decreased because of the CTC eligibility expansion requires knowing the entire CTC structure, not just the fact that you get a large tax bonus for working. The tax system is abstruse, and families usually interact with it through paid tax preparers or software that further obfuscates the mechanism by which families receive a larger or smaller refund. The University of Chicago team (and others that predict there will be employment decreases from the expanded CTC) assumes parents know the redesigned CTC has decreased their tax bonus for working, even though most low- to middle-income families are getting a larger total refund than in the past. This requires good knowledge of the tax system that is likely unrealistic.21In his commentary on the University of Chicago team’s paper, Scott Winship emphasizes that he (along with 13 other reviewers of the NAS modeling of a child allowance) did not realize that the expanded CTC decreased the return-to-work. If this change was so subtle as to escape the notice of a large panel of tax-policy and poverty experts, it is unlikely that millions of low-income parents will make this realization and quit working because of it.

Conclusion

While the expanded CTC has already begun to dramatically reduce child poverty, it has not been renewed past 2021. Much of the opposition to its renewal rests on predictions that a permanent credit will cause a significant fraction of parents to give up working, a position most forcefully argued by a group of economists at the University of Chicago. This brief demonstrates that these predictions rest on a tenuous base of evidence. A detailed look at what parents are expected to quit their jobs shows that the University of Chicago team predicts a very high fraction of moderate-income single mothers will leave formal employment and sustain significant declines in their total incomes and living standards. While these predictions rely on research showing increases in employment from expansions of the EITC, a critical look at that literature shows that any purported employment effect is inconsistent at best and at worst never directly attributable to expansions of the EITC. Finally, extrapolating the purported employment growth effects of the EITC to predict proportional decreases in employment from the expanded CTC is tenuous. In reality, joining the workforce may be more conducive to tax incentives than leaving the workforce, and the expanded CTC’s structure is significantly different from the EITC in a way that should mute any work disincentivizing effects.

Even researchers who predict some disemployment effects from the CTC using the same basic methodology show the keystone University of Chicago paper to be an exception in the scale of its predictions about parents quitting work.22Another paper found that even if you assume large employment declines, there is only a small reduction in anti-poverty effectiveness compared to assuming no job losses. Specifically, Jacob Goldin, Elaine Maag, and Katherine Michelmore estimate that 385,000 parents will quit working, Jacob Bastian estimates 413,000 parents will quit; Alex Brill, Kyle Pomerleau, and Grant M. Seiter (a team at the American Enterprise Institute) estimate 296,000 (+/- 155,000) full-time job losses. The University of Chicago team’s estimate of 1.5 million parents quitting work is a clear outlier.

However, this brief demonstrates that even these analyses may be too pessimistic when predicting small employment declines from the expanded CTC.23In fact, if researchers applied the methodology of papers predicting relatively small amounts of job loss from the expanded CTC to the Romney Child Allowance plan, they would predict substantially more job loss since his plan also reduces the EITC and other allegedly work-incentivizing tax credits. Taking a given change in the tax credit’s incentive to work and plugging in a labor supply elasticity is a fraught enterprise. The research base alleging changes in taxes cause changes in labor force participation is weak, particularly beyond the EITC.24 The University of Chicago team cites two different literature reviews to justify their elasticities. The Chetty et al. paper limits their review to “quasi-experimental estimates” rather than structural models of labor supply elasticities that require extremely strong assumptions. (The other review finds similar elasticity estimates, despite including more non-credible studies). Of the studies the Chetty et al. team reviews, only three are U.S-based and use non-EITC sources of variation. These three studies are riddled with problems, including studying variations in labor supply in response to wages (rather than taxes, that should be less salient), studying high-income groups not relevant to the CTC, and large standard errors that do not rule out zero employment change. Most importantly, all the studies suffer from clear endogeneity issues that make it unclear whether the observed changes in labor supply are attributable to the estimated change in the return-to-work. Even if you trust these estimates, applying them to the expansion of the Child Tax Credit to predict employment declines involves a bevy of untenable assumptions. While researchers may be unable to confidently declare that a permanent Child Tax Credit expansion will not cause any long-run decline in parental employment, a clear reading of the best available evidence shows that it will be minimal and that large job quitting estimates must be treated as uncertain at best.

Read the Appendix here.