News

News

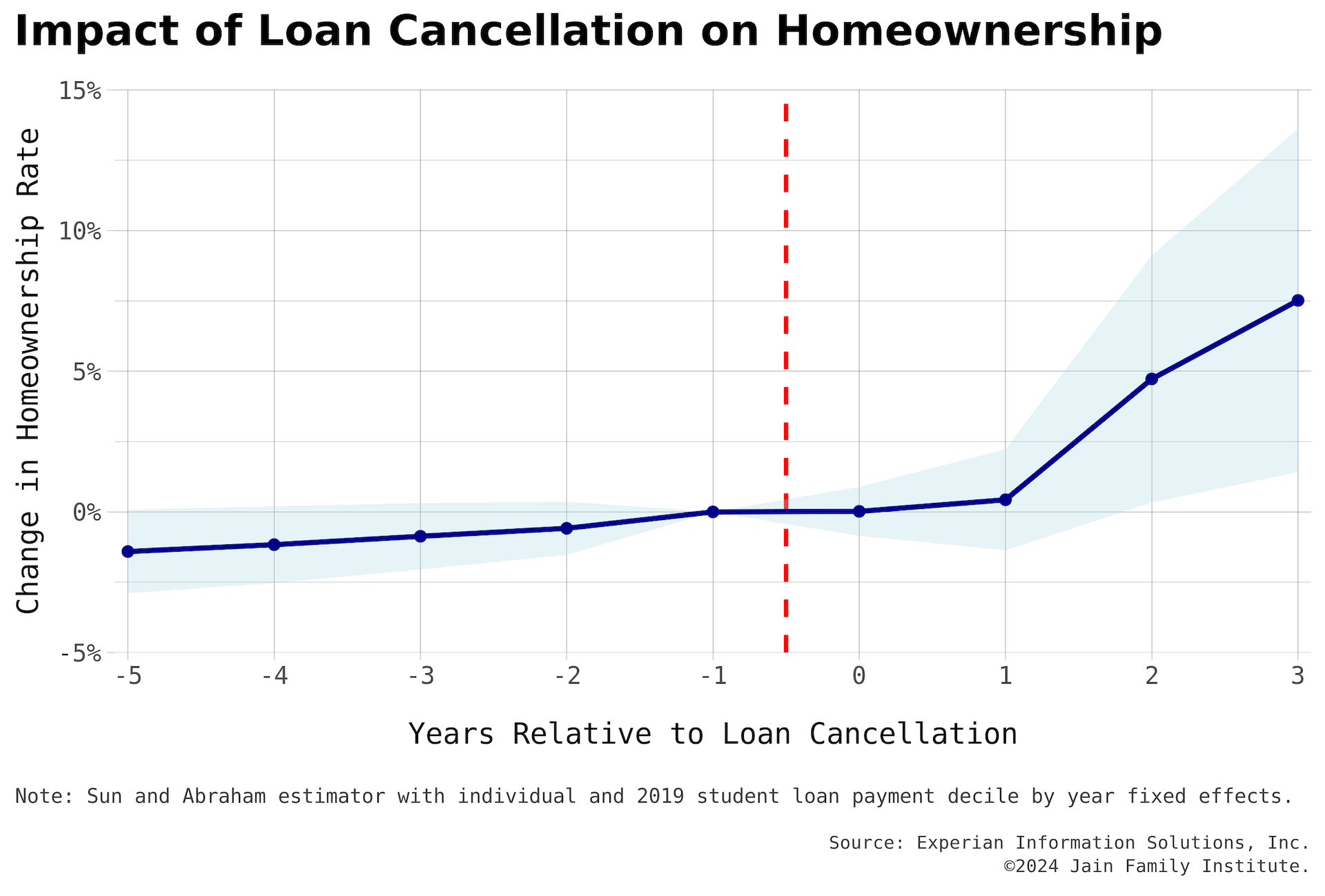

AllNew Report on Student Debt Cancellation; Coverage in Marketwatch

Marketwatch: "The analysis is the first to provide a sense of who has benefited from the $153 billion in debt cancellation...

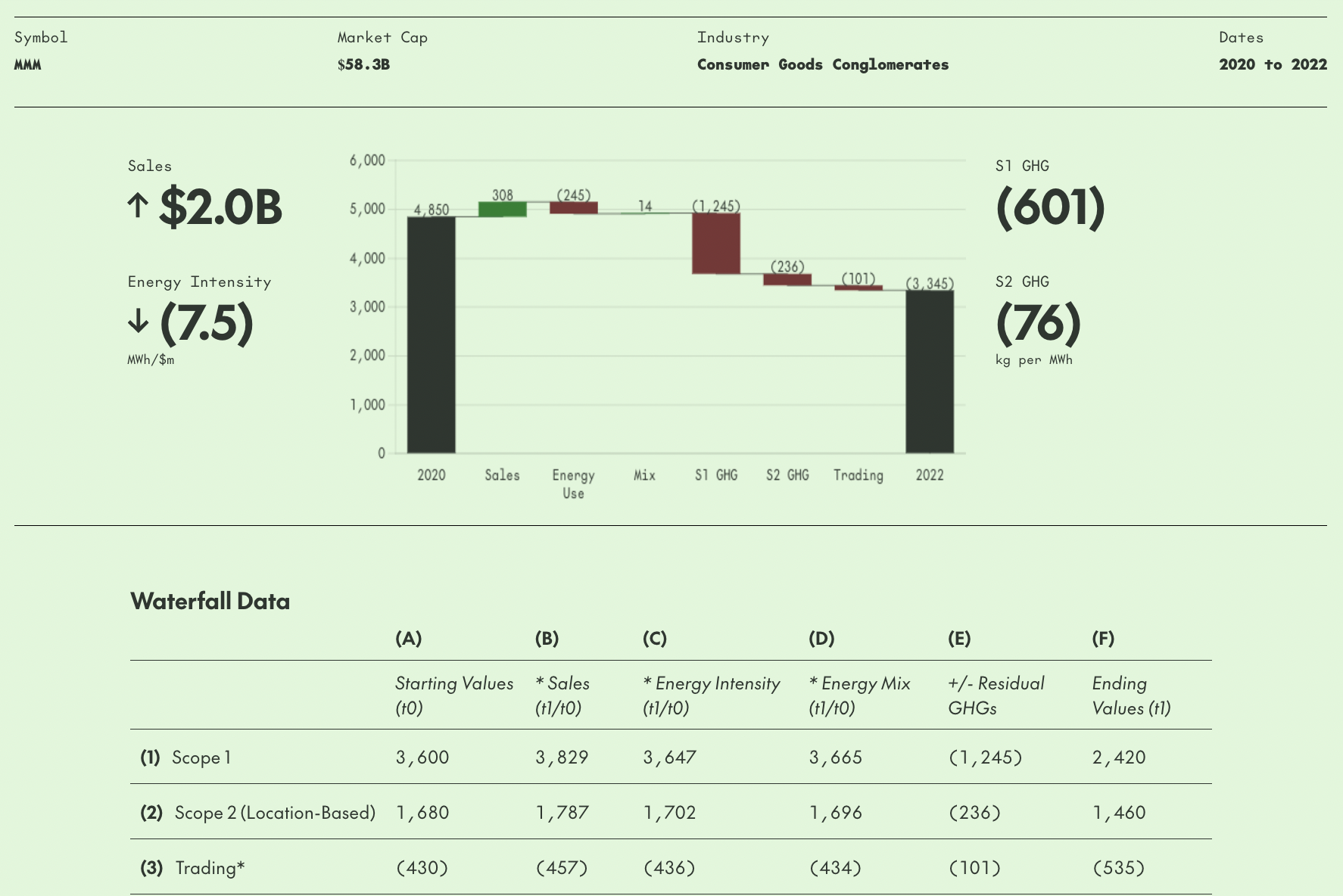

Center for Active Stewardship’s Splice tool in the Financial Times

"The case against carbon emissions as a universal metric"

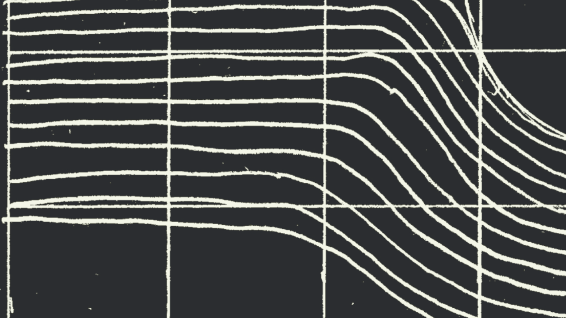

Center for Active Stewardship launches Splice, a tool for visualizing how a company’s greenhouse gas emissions change over time

"When it comes to emissions reporting, it’s important to be able to separate signal from noise. Initiatives to reduce...

ISA research cited by White House and others

This research formed part of a White House issue brief, "The Economics of Administration Action on Student Debt."

News Coverage of Phenomenal World’s Brazil Launch with Adam Tooze

Widespread coverage of Brazilian Minister of Finance Fernando Haddad's comments during the launch event.

Working Paper — Navigating Higher Education Insurance: An Experimental Study on Demand and Adverse Selection

A survey-based experiment in collaboration with the Philadelphia Federal Reserve.

Events

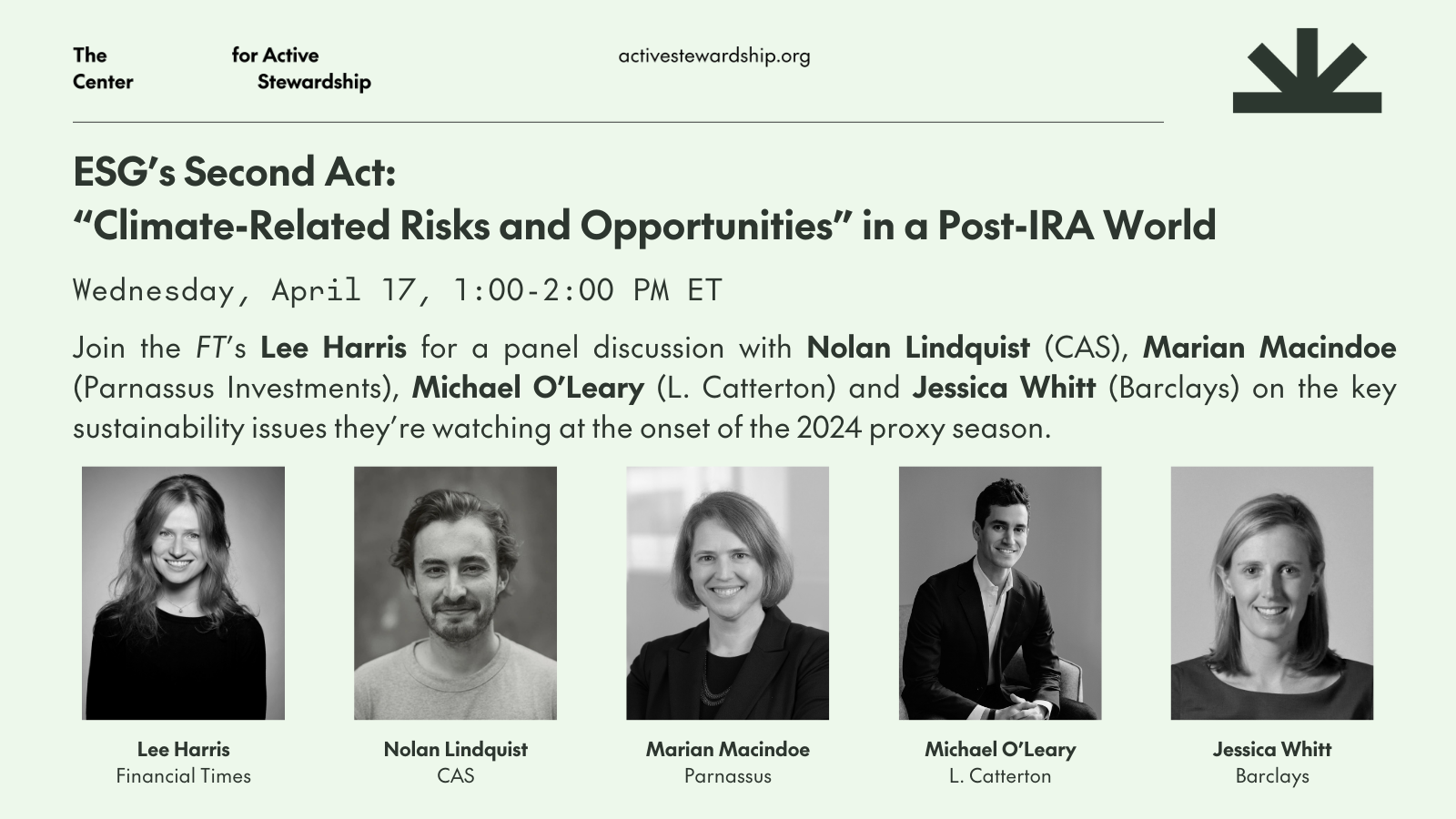

AllPanel April 17: ESG’s Second Act: “Climate-Related Risks and Opportunities” After the IRA

Exploring the disconnect between NGO priorities and how investors in public and private markets are analyzing "climate-related risks and opportunities"

Phenomenal World International Expansion: Two Discussions

April 5th at 5pm Eastern Time: Fernando Haddad and Adam Tooze in conversation, and more.

Event: We Take Mumbucas: Charting the Complementary Currency that’s Transforming a Brazilian City

A virtual event, Friday, June 30 from 1-2:30pm ET.

Phenomenal World Event: Varieties of Derisking

On industrial policy, state capacity, macrofinance, and the green transition.

“Stewarding” the Energy Transition: A Discussion

A discussion with Madison Condon and Benjamin Braun on how the asset management industry is approaching climate change.

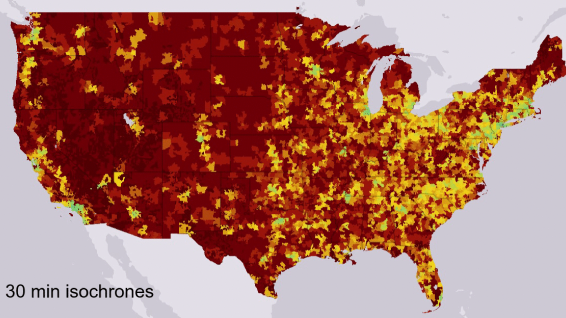

Forum on Education Deserts: Supporting Rural Regions With Fewer Colleges

On May 23, The Chronicle of Higher Education hosts a forum featuring JFI's Laura Beamer on higher education deserts in the...